How to Set up Recurring Payments on Zelle? The advancement of technology and digitalization have made it easier than ever to manage our money. Peer-to-peer payment services like Zelle have revolutionized the way we handle our finances and have made it possible to take advantage of them.

With Zelle, you can split bills with friends, send money to family, and make regular payments, but how do you create recurring payments?

In order to avoid having to worry about the transactions related to your monthly contributions and scheduled payments, you should automate them. We will show you how to streamline your financial responsibilities in this blog post so that you can manage your money without being stressed out. # Set up Recurring Payments on Zelle

Is Zelle always automatic?

You can send money directly between your bank accounts in the United States using Zelle. It uses the Automated Clearing House (ACH) to expedite payments between U.S. banks.

Sending and receiving money with Zelle is free, and transactions usually take just a few minutes. # Is Zelle always automatic

It may not always be automatic, however. It depends on whether the recipient has already enrolled with Zelle. If they have, the money will be transferred directly to their bank account in a matter of minutes.

It will take 14 days before the transfer expires for those who have not enrolled yet. They will receive a notification explaining how to receive the funds.

You can check whether a recipient is enrolled by entering their email address or phone number in the app. Upon confirmation, you will see their name and the logo of their bank. If they are not enrolled, a message will be displayed asking you to verify their information. # Is Zelle always automatic

Can You Set Up Recurring Payments On Zelle?

Automatic payments can be set up through Zelle if your bank supports it. Most U.S. banks support this feature.

Contact your bank to find out whether it’s available to you.

Zelle is available to all eligible institutions, and it can be integrated into their apps or used as a standalone application.

A number of new features have been added to the banking app due to the integration of Zelle, including the ability to make recurring payments and to send payments directly to another bank.

The Zelle recurring feature makes it easy for you to set up automatic payments for subscriptions and bills straight from your bank account.

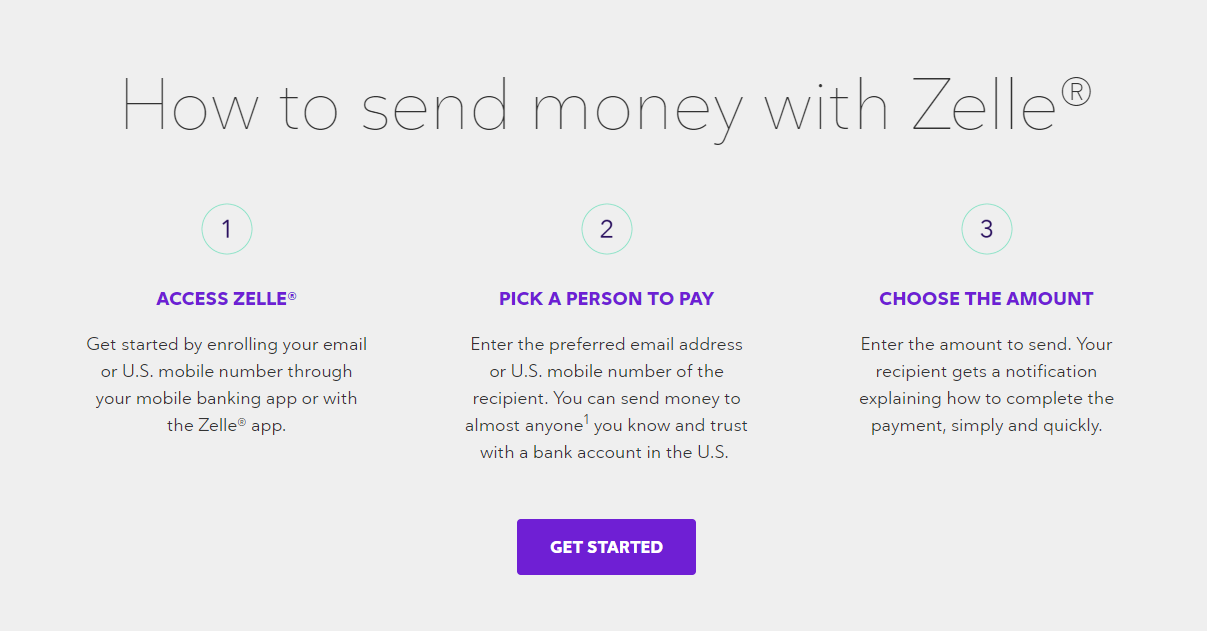

What is Zelle?

Using Zelle, you can transfer funds between bank accounts in the United States in a fast, secure, and convenient way. With Zelle, you don’t need cash or checks to pay your friends, family, or businesses.

It is a digital payment network that lets users transfer funds with just a mobile phone number or email address.

The speed and convenience of Zelle make it stand out from other payment platforms. With Zelle, you can send money and receive money within minutes, unlike traditional methods that require several business days to transfer funds.

As a result, you can split bills, repay loans, share costs, and even send monetary gifts.

With Zelle, you can have peace of mind knowing that your money is transferred safely and confidentially. With Zelle’s robust security measures, you can also transfer money without cash or checks.

How to Set up Recurring Payments on Zelle?

In the context of Zelle, one-time peer-to-peer payments are its primary focus, and recurring payments are not supported natively.

If you use Zelle in conjunction with your bank’s online banking services, you can still set up recurring payments. # Set up Recurring Payments on Zelle

Here’s how:

Method 1: Use Your Bank’s Bill Pay Service with Zelle

Log In to Your Bank’s Online Banking:

By logging in with your credentials, you will be able to access your bank’s online banking platform.

Navigate to Bill Pay:

Depending on your bank, you may have to find and select the “Bill Pay” option from within your online banking account. You may find this option labeled as “Pay Bills,” “Bill Pay,” or something similar, depending on your bank.

Add Payee (Recipient):

You will need to add the payee, which is the person or company to whom you want to send money, to your list of payees. You will need to provide the name, address, and account details of the payee. # Set up Recurring Payments on Zelle

Set Up Recurring Payments:

You will find an option to set up recurring payments. This may be labeled as “Recurring Payment” or something of the sort.

Specify Payment Details:

If applicable, you will need to choose the frequency of the payments (e.g., monthly), the start date, and the end date of the payments (if applicable). You will also need to specify the amount of each payment.

Select the Payment Method:

If you have chosen a funding account (the account from which the money will be deducted) and selected Zelle as the payment method, you will be able to proceed with the transaction.

Review and Confirm:

To ensure that the details of your recurring payment are accurate, you should carefully review them.

Save and Activate:

The recurring payment will be activated once you have saved and confirmed that you are satisfied.

Depending on your particular bank, the ability to set up recurring payments through your bank’s bill pay service can differ. # Set up Recurring Payments on Zelle

Not all banks, as well as some credit unions, may be able to offer recurring payments managed via Zelle through their bill pay systems.

Method 2: Set Up Manual Recurring Payments

There are two options for setting up recurring payments. If your bank’s online bill pay service does not support Zelle or recurring payments, you can set them up manually by creating calendar reminders. Schedule a reminder for each payment, and manually initiate the Zelle transfer on the scheduled date.

Make sure you always have enough funds in your account to cover any recurring payments that you may have to make in order to avoid being charged an overdraft or an insufficient funds fee.

How do I manage recurring payments on Zelle?

Using Zelle, you can send and receive money directly between US bank accounts. The unique feature of Zelle is the ability to schedule recurring payments. Recurring payments allow you to manage your regular expenses more easily.

If you need to pay rent, utilities, or subscriptions on a regular basis, then you can set up recurring payments with Zelle so that you can be sure your payments are sent out automatically. # recurring payments on Zelle

Using Zelle, you don’t need to worry about setting reminders or worrying about missing due dates – Zelle takes care of all of that for you and automates all of that for you.

In order to set up recurring payments using Zelle, you need to follow the steps below:

- If Zelle is part of your bank’s service, you can install the Zelle app from the Google Play Store or Apple App Store.

- You can use the Zelle app in the app store of your bank to enroll recipients in Zelle by adding their phone number or email address.

- You can set up weekly, biweekly, monthly, and custom payments. You can also manually enter the amount.

- You will receive an email notification once we receive your payment and review the details.

- If you have any existing recurring payments set up with Zelle or your bank, select the Scheduled tab to manage or edit them.

The official website of Zelle can be accessed for more information. # recurring payments on Zelle

Zelle doesn’t include accepting recurring payments

In some banks, Zelle payments can be programmed, but the customer must initiate the payment, not you. Cell payments cannot be refunded.

Moreover, merchants cannot request money with Zelle. Instead, they must create a Zelle request through their online banking platform to charge customers.

Even though having dinner with friends might be easy sometimes, running a business wouldn’t be.

As less than 35% of your customers use Zelle for this purpose (Venmo is #1), it may not be convenient for them to use the app for this purpose.

How often can you make a Zelle transfer?

Zelle does not limit how often you can make money transfers. If you have funds available in your linked account, you may send money through Zelle as often as you like.

Cell transfers may vary in frequency and limit depending on your bank or credit union’s policies.

The amount you can transfer through Zelle may be limited by your financial institution. Additionally, security measures may be in place to prevent fraud by monitoring unusual or high-frequency transfers.

The best way to find out what your cell transfer limits and frequency are is to contact your bank or credit union. They can provide you with any limits they have on cell transfers, and can help you adjust them when necessary.

How to change the address of an order in Shein?

Conclusion

You can manage your regular expenses with Zelle recurring payments. With Zelle’s recurring payments, your payments are automatically sent out on time, so there are no late fees or missed payments.

This guide demonstrates how to set up recurring payments on Zelle. Once you have downloaded and installed the Zelle app, you will need to add recipients and create an account.

The next step was to set up recurring payments, review and confirm their details, and manage and edit them.