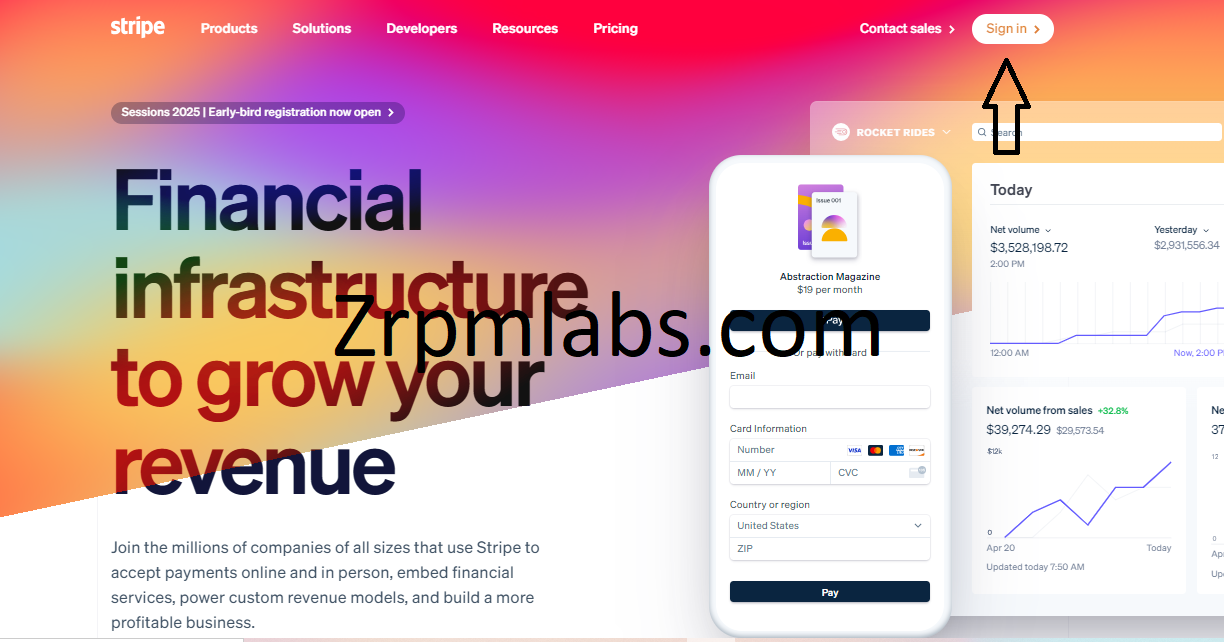

Check this guide on how to open stripe account in Kenya? In the modern digital landscape, online payments are crucial for businesses, freelancers, and entrepreneurs. Stripe, a prominent global payment platform, provides a dependable solution for processing payments from clients worldwide.

Although Stripe is not fully operational in Kenya, there are ways to access its services. With a few alternative steps, you can leverage Stripe to manage your online payments effectively.

This guide will walk you through the process of opening a Stripe account in Kenya, helping you expand your business and reach global markets effortlessly. # open stripe account in Kenya

Does Stripe Work In Kenya?

Stripe, a leading global payment processing platform, is renowned for its robust features that facilitate seamless online transactions. However, Stripe does not operate directly in Kenya.

Despite this limitation, Kenyan businesses can still access Stripe’s services through alternative methods. Here’s an in-depth look at how Stripe can work in Kenya and the options available for Kenyan businesses. # Does Stripe Work In Kenya

>> Setting Up Stripe via US Company Formation

- Forming a US-Based Entity: The most common workaround is to form a business entity in the United States, such as a Limited Liability Company (LLC). This enables you to meet Stripe’s requirements for operating in a supported country.

- Obtaining an EIN: After setting up your LLC, you’ll need to obtain an Employer Identification Number (EIN) from the IRS. The EIN is essential for tax purposes and is a requirement for opening a Stripe account.

- Providing a US Physical Address: You will need a physical address in the US. This can be arranged through services that offer registered agent addresses.

- Setting Up a US Phone Number: A US phone number is also necessary for verification and communication purposes.

- Opening a US Bank Account: Finally, you will need a US bank account to receive payments. Several financial institutions and fintech companies offer services to non-residents, facilitating this process.

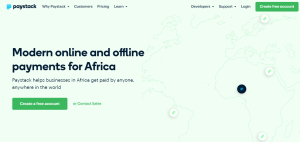

>> Using Paystack, a Stripe Subsidiary

Another alternative is using Paystack, a Nigerian-based payment processor acquired by Stripe. While Stripe itself does not support direct operations in Kenya, Paystack can be used to access many of Stripe’s features.

- Registration: Begin by registering on Paystack’s platform.

- Verification: Complete the verification process by providing necessary documents like your business registration, ID, and bank account details.

- Integration: Integrate Paystack with your website or mobile application using their API, which works similarly to Stripe’s API.

How to open stripe account in Kenya?

Opening a Stripe account in Kenya can be a bit challenging since Stripe does not officially support Kenya. However, there are alternative methods to access Stripe’s services. # stripe account

Here’s a simplified guide to help you set up a Stripe account from Kenya:

Step-by-Step Guide

1. Form a Business in a Stripe-Supported Country

To begin, you’ll need to register a business entity in a country where Stripe is supported, such as the United States. This can be done by forming a Limited Liability Company (LLC) or a similar business structure. Many services can help you set up a US-based business remotely.

2. Obtain an EIN (Employer Identification Number)

After registering your business, you’ll need to apply for an EIN from the IRS, which is used to identify your business for tax purposes. This is necessary for linking your business to Stripe.

3. Set Up a US Bank Account

Stripe requires a bank account in the same country where your business is registered. You can set up a US bank account using virtual banking services like Payoneer or Wise (formerly TransferWise), which allow you to receive payments from Stripe.

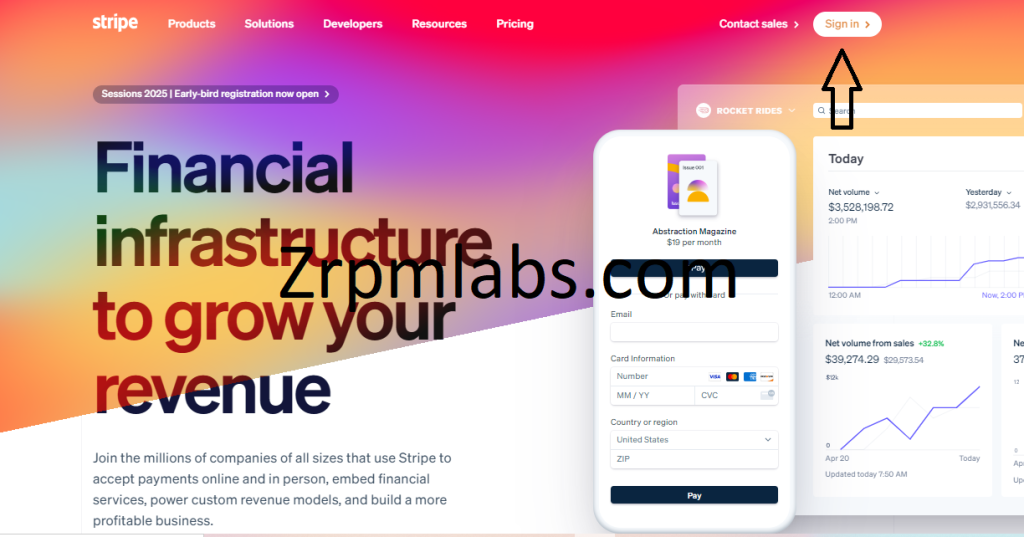

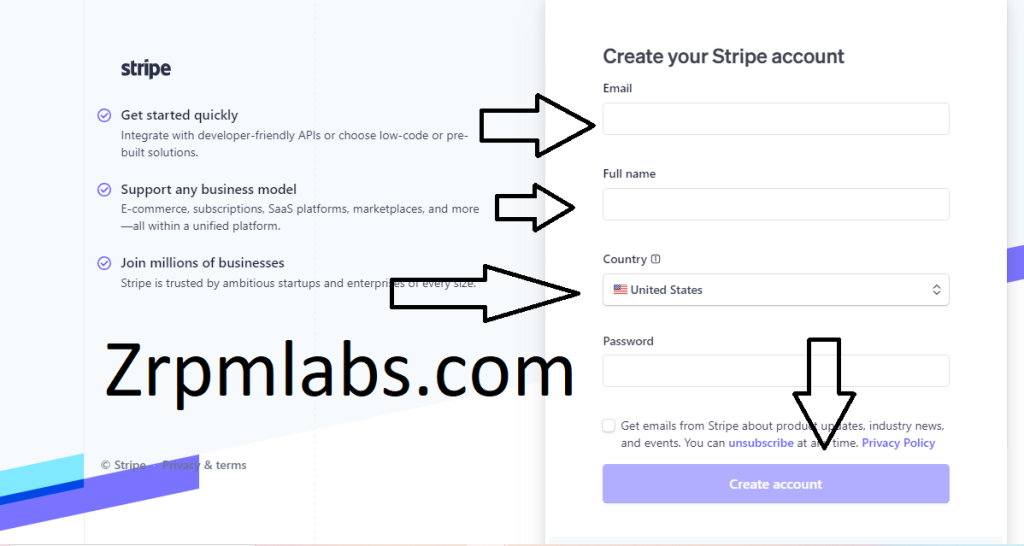

4. Register for a Stripe Account

Go to the Stripe website and click on “Start Now.” Enter your details, such as your email, name, and country, and then verify your email address to create your account. # stripe account

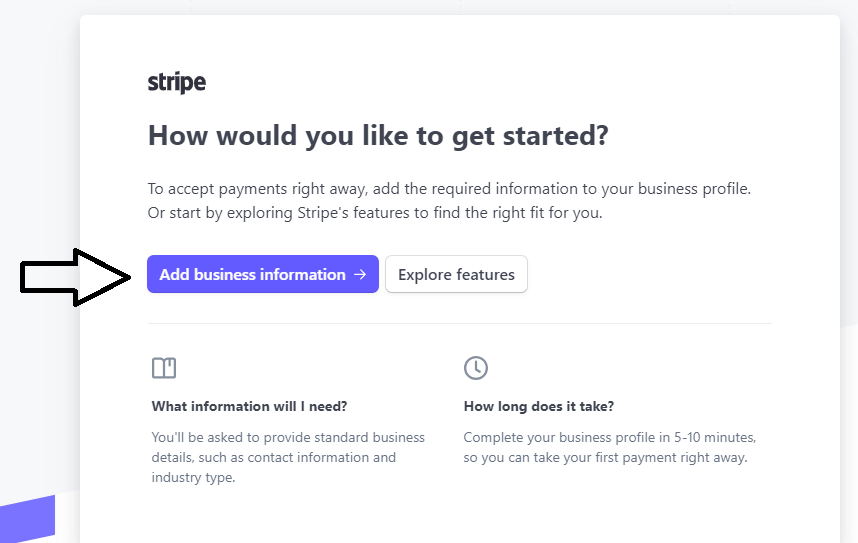

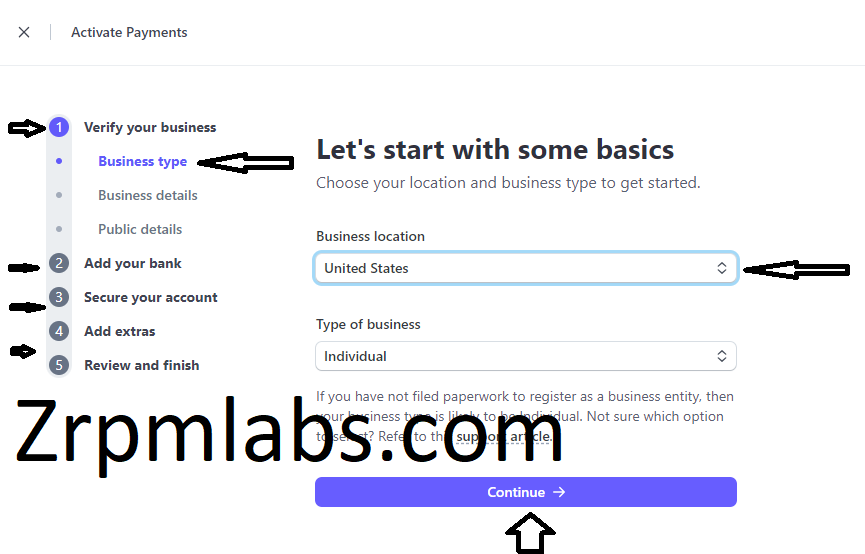

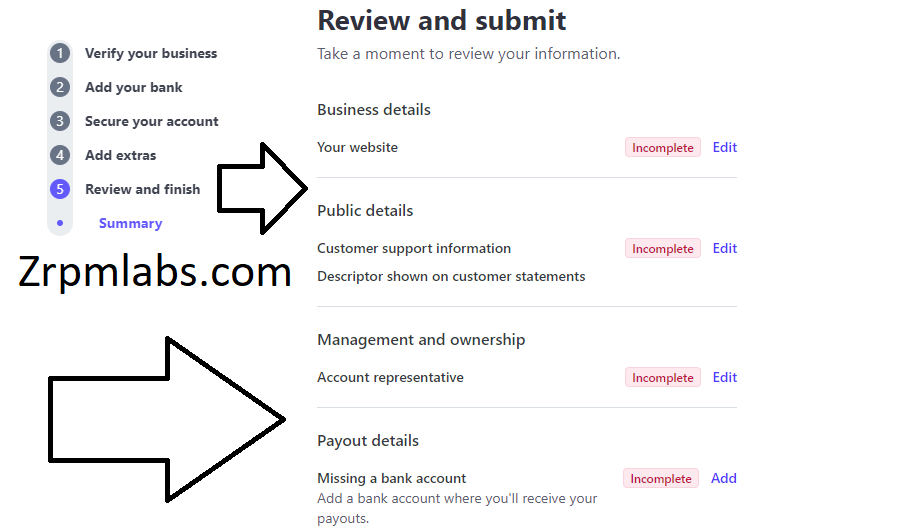

5. Complete Your Profile

Fill in your business information, including your legal name, date of birth, address, industry, and a description of your business. You will also need to provide a statement descriptor (what appears on customers’ payment statements) and a customer support phone number.

6. Connect Your Bank Account

To link your US bank account with Stripe, enter your account and routing numbers. You will also need to set up two-factor authentication (2FA) for security using an app or SMS. Make sure to save your backup codes in case you lose access to 2FA.

7. Integrate Stripe with Your Platform

You can now integrate Stripe into your website or application using their API. Stripe offers developer-friendly documentation to guide you through the process.

Platforms like WooCommerce, Shopify, or custom websites are commonly used for integration.

8. Test the Integration

Before going live, you should test the payment gateway to ensure everything is functioning correctly. Stripe provides a test mode where you can simulate transactions and troubleshoot any issues.

9. Go Live

Once everything is set and you’re confident the integration works smoothly, switch to live mode. Your platform will now be able to accept payments through Stripe, and you can start receiving funds. # stripe account

Does Stripe accept Mpesa?

While Stripe does not natively support M-Pesa payments, there are still ways to accept M-Pesa payments alongside Stripe by leveraging third-party platforms such as Paystack or Flutterwave.

These platforms integrate M-Pesa into their payment gateways, acting as intermediaries, allowing you to handle both local and international payments seamlessly. # Does Stripe Work In Kenya

Here’s a more detailed look at how it works:

How It Works:

>> Local Payments via Paystack/Flutterwave:

Paystack and Flutterwave enable you to accept payments from M-Pesa users in Kenya. These platforms support various local payment methods, making it easier for customers to pay using M-Pesa.

>> International Payments via Stripe:

Stripe handles international card and bank payments, allowing you to accept payments from customers around the world.

>> Integration with Your Platform:

Both Paystack/Flutterwave and Stripe can be integrated into your website or online store, offering a wide range of payment options to your customers. This integration provides a seamless payment experience, combining the strengths of both platforms. # Does Stripe accept Mpesa

How to Integrate Paystack to Accept M-Pesa Payments with Stripe?

Integrating Paystack to accept M-Pesa payments alongside Stripe on your platform can greatly enhance your business’s ability to serve customers in Kenya and across Africa. Here’s a step-by-step guide to set it up:

1. Sign Up for Paystack

Head to the Paystack website and create an account by entering your business information. Ensure all the details are correct to avoid any issues during verification.

Submit the necessary documents such as your business registration, ID, and bank account details to verify your account. Paystack may ask for additional information to confirm your business identity.

2. Access the Developer Dashboard

Once verified, log into your Paystack account and go to the developer dashboard. Here, you will find API keys, which are crucial for integrating Paystack with your website or application. # Integrate Paystack to Accept M-Pesa Payments with Stripe

3. Integrate Paystack API

Use the API keys provided to connect Paystack to your platform. Paystack offers detailed guides and documentation to help you with the integration, allowing you to accept M-Pesa and other payment methods Paystack supports. # Integrate Paystack to Accept M-Pesa Payments with Stripe

4. Test the Integration and Go Live

Before going live, use Paystack’s test mode to simulate transactions and make sure everything works correctly. This helps you identify and resolve any potential issues. Once testing is complete and successful, switch to live mode. You can now accept M-Pesa payments along with other options available through Paystack.

What is required to open a Stripe account?

To open a Stripe account, you’ll need the following:

- Legal Entity: A registered business like an LLC or corporation in the country where you are opening the account.

- Tax ID: A tax identification number (TIN) for tax compliance in that country.

- Physical Address: A real address in the country (not a P.O. box) for receiving mail.

- Phone Number: A local phone number for verification and communication.

- Government ID: A valid government-issued ID (e.g., passport or driver’s license).

- Website: A functional website showing your business and services.

- Bank Account: A physical bank account in that country, denominated in a supported currency (virtual accounts are not allowed).

- Age Requirement: You must be at least 18 years old.

- Consent: Agree to Stripe’s Terms of Service.

This ensures compliance with Stripe’s requirements for creating an account. Read about How to Set up Recurring Payments on Zelle?

Conclusion

While setting up a Stripe account in Kenya may initially appear daunting, it is entirely manageable with the right approach. By following this guide, you can utilize Stripe’s robust features to enhance your business operations and extend your reach to a global audience.

Whether you are a freelancer, an e-commerce store owner, or a service provider, Stripe offers a seamless and secure method to receive payments. Embrace this opportunity today and unlock the potential of streamlined online transactions for your business.