Learn how To Download KRA Return Receipt Online? Filing tax returns with the Kenya Revenue Authority (KRA) is an essential task for every taxpayer. Once you’ve successfully submitted your returns, obtaining the KRA returns receipt is crucial as it serves as proof of compliance.

This receipt can be needed for various purposes, including employment verification, tender applications, and financial transactions.

Fortunately, the process of downloading your KRA returns receipt online is simple and straightforward through the iTax portal. In this guide, we will walk you through the steps to access and download your KRA returns receipt effortlessly. # Download KRA Return Receipt

KRA Return Receipt

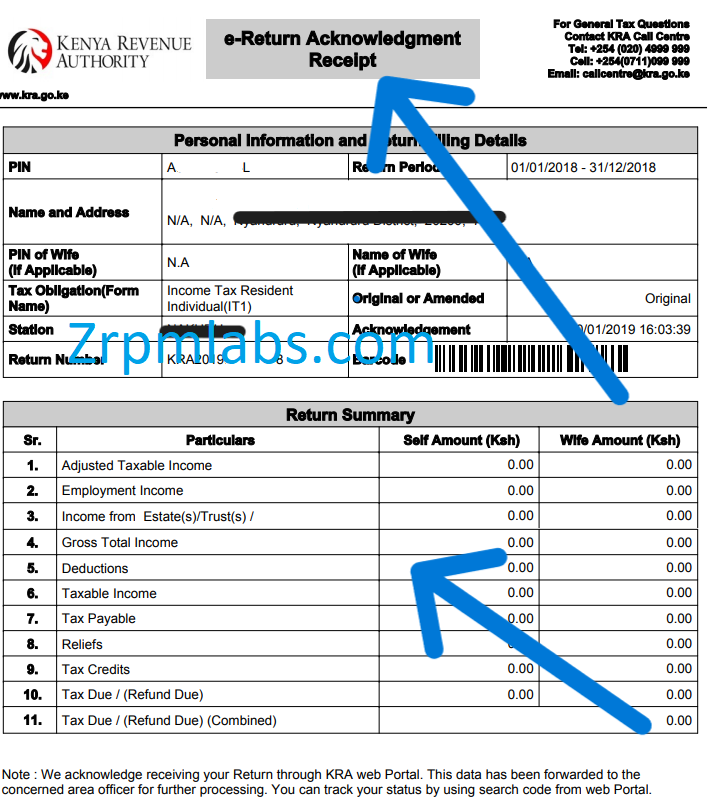

A KRA Returns Receipt is an official document issued by the Kenya Revenue Authority (KRA) as proof that an individual or business has successfully filed their tax returns.

This receipt confirms that the taxpayer has met their obligations for the specified period, whether it’s for income tax, VAT, or other taxes. It typically contains important details such as the taxpayer’s PIN, the type of return filed, and the date of submission.

The KRA Returns Receipt serves several purposes, including:

- Proof of Tax Compliance – Employers, financial institutions, and government bodies often require this document to confirm that you are compliant with tax laws.

- Employment Applications – Some employers may request a KRA returns receipt as part of the job application process to ensure candidates are tax compliant.

- Tender Applications – Businesses applying for tenders may need to submit their KRA returns receipt as evidence of tax compliance.

- Financial Transactions – Some financial services, such as loans or credit applications, require proof that you are up-to-date with your tax filings.

Downloading the KRA returns receipt is done through the iTax portal, ensuring you can easily access and store it for any required use.

As mentioned above, for you to download your KRA Returns Receipt online, you to access your account first using both your KRA PIN Number and KRA Password (iTax Password).

Below is a brief description about what these two entails in relation to the process of downloading KRA Returns Receipt using KRA Portal (iTax Portal).

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal (iTax Portal).

If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online and KRA support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of downloading KRA Returns Receipt on iTax Portal (KRA Portal) is your KRA Password (iTax Password), which you will need to access your KRA Portal account.

If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.”

Requirements for Downloading Your KRA Returns Receipt Online

To download your KRA Returns Receipt online, you need access to your account using your KRA PIN Number and KRA Password (iTax Password). Here’s a simple explanation of what you need:

KRA PIN Number: Your KRA PIN Number is essential for logging into the KRA Portal (iTax Portal). If you’ve forgotten your PIN, you can request a PIN retrieval online. If you need a new KRA PIN Number, you can register for one online, and it will be sent to your email once processed.

KRA Password (iTax Password): You’ll also need your KRA Password to access your iTax account. If you’ve forgotten your password, you can reset it by following the instructions online.

A new password will be sent to your email. Make sure your email on the KRA iTax Portal is up-to-date. If it isn’t, you can request a change of email address online.

By having these two pieces of information—your KRA PIN Number and KRA Password—you’ll be able to log in to the KRA Portal and download your returns receipt without any issues.

How To Download KRA Returns Receipt Online?

To download your KRA Returns Receipt online, follow these steps:

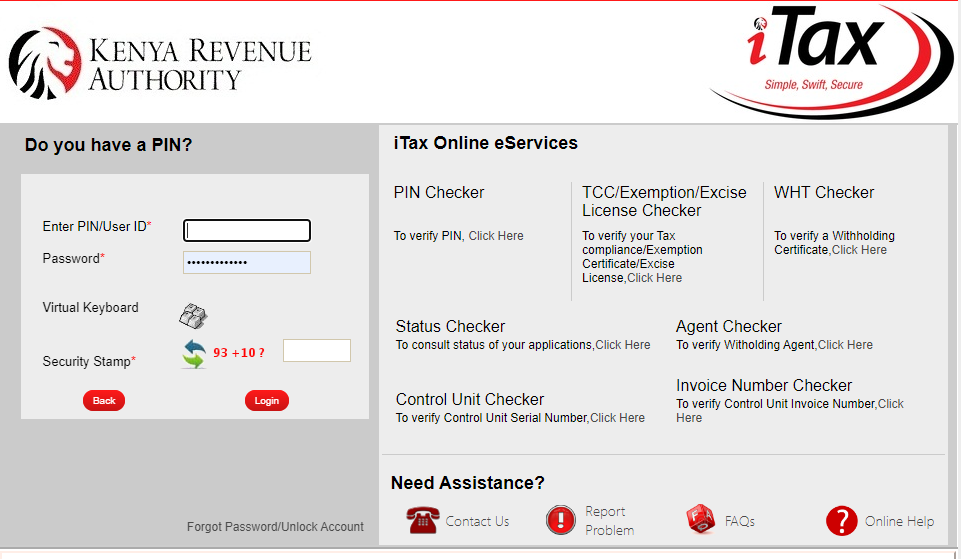

- Visit the KRA iTax Portal: Open your web browser and go to the official KRA iTax Portal at iTax Portal.

- Log In: Use your KRA PIN and password to log into your iTax account.

- Access Useful Links: Once logged in, hover over the “Useful Links” tab and click on “Consult and Reprint Acknowledgement Receipt and Certificates”.

- Fill the Form: Complete the “Consult and Reprint Acknowledgement Receipt Form” by selecting the appropriate tax period and other required details.

- Download the Receipt: Click on the acknowledgment serial number to download your KRA Returns Receipt.

This receipt serves as proof that you have successfully filed your returns. If you encounter any issues, KRA’s customer support is available to assist you.

How to Download KRA Return Receipt on KRA Portal?

To download your KRA Returns Receipt from the KRA portal (iTax), follow these simple steps:

Step 1: Visit the KRA Portal

The first step is to visit the KRA Portal. Click on this link which will open the KRA Portal in a new browser tab.

Step 2: Enter KRA PIN Number

Enter your KRA PIN Number. If you have forgotten it, you can request a KRA PIN retrieval, and your KRA PIN will be emailed to you. After entering your KRA PIN, click on the “Continue” button to proceed.

Step 3: Enter KRA Password and Solve Arithmetic Question (Security Stamp)

Next, enter your KRA Password and solve the arithmetic question (security stamp). If you’ve forgotten your KRA Password, you can reset it. Once you receive the new password in your email, use it to log in. Click the “Login” button to access your KRA Portal Account.

Step 4: Access KRA Portal Account Dashboard

After entering the correct KRA Password and solving the arithmetic question, you will be logged in successfully and will see your KRA Portal Account Dashboard.

Step 5: Click on Useful Links Then Consult and Reprint Acknowledgement Receipt and Certificate

Click on the “Useful Links” tab and then click on “Consult and Reprint Acknowledgement Receipt and Certificate” from the dropdown menu.

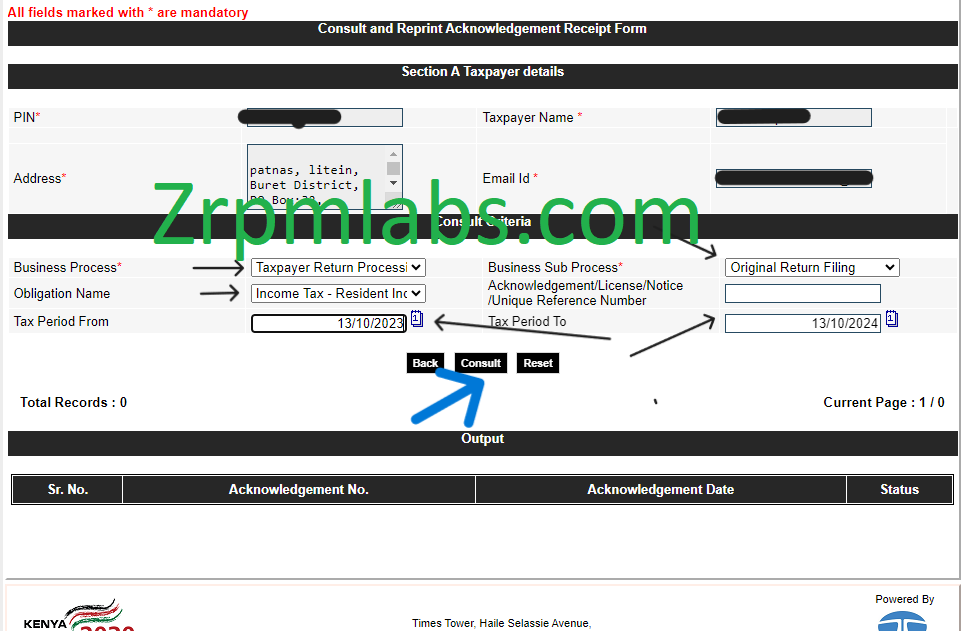

Step 6: Fill the Reprint Acknowledgement Receipt Form

To download the KRA Return Receipt, fill in the fields under “Consult Criteria” in the Reprint Acknowledgement Receipt Form:

- Business Process: Taxpayer Return Processing

- Business Sub Process: Original Return Filing

- Obligation Name: Income Tax Resident – Individual

- Tax Period From: 01/01/2020

- Tax Period To: 31/12/2020

Once you have filled in the above sections, click on the “Consult” button.

Step 7: Download the KRA Return Receipt

Your KRA Return Receipt will be displayed, containing your Personal Information, Return Filing Details, and KRA Return Summary.

Following these steps ensures you can easily download your KRA Return Receipt from the KRA Portal. If you encounter any issues, KRA’s customer support is available to assist you.

Read About How to Get Your GHRIS Payslips Online and How To Check Your KRA PIN Using KRA PIN Checker?

Conclusion

Downloading your KRA returns receipt online is a convenient process that allows you to access and store your tax compliance proof at any time. By following the steps provided through the iTax portal, you can ensure that you have your tax records readily available when needed.

This not only keeps you compliant with tax regulations but also prepares you for any situations where proof of your KRA returns might be required. Stay proactive by downloading your returns receipt after filing, and safeguard your financial documentation with ease.