This is complete guide on how To Check Your KRA PIN Using KRA PIN Checker? Your KRA Personal Identification Number (PIN) is an essential part of your financial and tax obligations in Kenya.

Whether you need it for filing tax returns, applying for a job, or handling business transactions, having access to your KRA PIN is crucial. If you’ve misplaced your KRA PIN or simply want to verify it, the Kenya Revenue Authority offers an easy-to-use online tool known as the KRA PIN Checker.

This guide will show you how to quickly check and verify your KRA PIN using this tool, ensuring you have your tax information at your fingertips when needed. # Check Your KRA PIN Using KRA PIN Checker

KRA PIN Checker

The KRA PIN Checker, offered by the Kenya Revenue Authority (KRA), is an online tool designed to help individuals and businesses verify the validity of their KRA Personal Identification Number (PIN).

This tool ensures that a KRA PIN is active and correctly linked to the appropriate taxpayer, which is crucial for adhering to tax regulations in Kenya. The KRA PIN is essential for a variety of tasks, including filing tax returns, job applications, financial transactions, and business operations.

By using the KRA PIN Checker, both individuals and companies can confirm the accuracy of a PIN, ensuring that all tax-related activities are correctly associated with the right identity.

The KRA PIN Checker streamlines this verification process, offering a secure and efficient method to confirm tax details online.

KRA PIN Using KRA PIN Checker Requirements

To check your KRA PIN using the KRA PIN Checker, you’ll need the following documents:

- KRA PIN Number: Ensure you have your KRA PIN Number, as it is essential for logging into the KRA Portal (iTax Portal).

- National ID/Alien ID Card: Your identification details are required for verification purposes.

- Email Access: You’ll need access to the email address associated with your KRA account, as KRA will send important information to this email.

These documents will help you verify your KRA PIN and ensure that your tax information is accurate and up-to-date. If you encounter any issues, KRA’s customer support is available to assist you.

How to Check Your KRA PIN Using KRA PIN Checker?

The Kenya Revenue Authority (KRA) has made it easier for taxpayers to verify the validity of their Personal Identification Numbers (PINs) with the KRA PIN Checker.

This online tool allows individuals and businesses to confirm their tax identification details efficiently and securely.

Let’s walk you through the process step-by-step, ensuring you have all the important details and extra information you need.

Steps to Check Your KRA PIN Using KRA PIN Checker

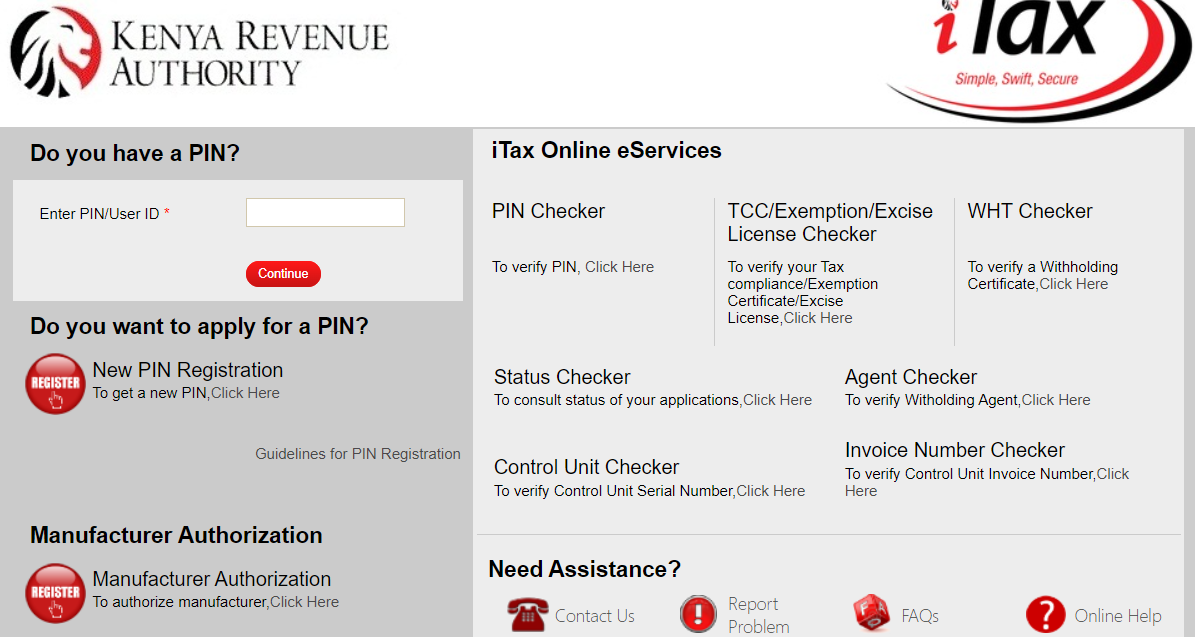

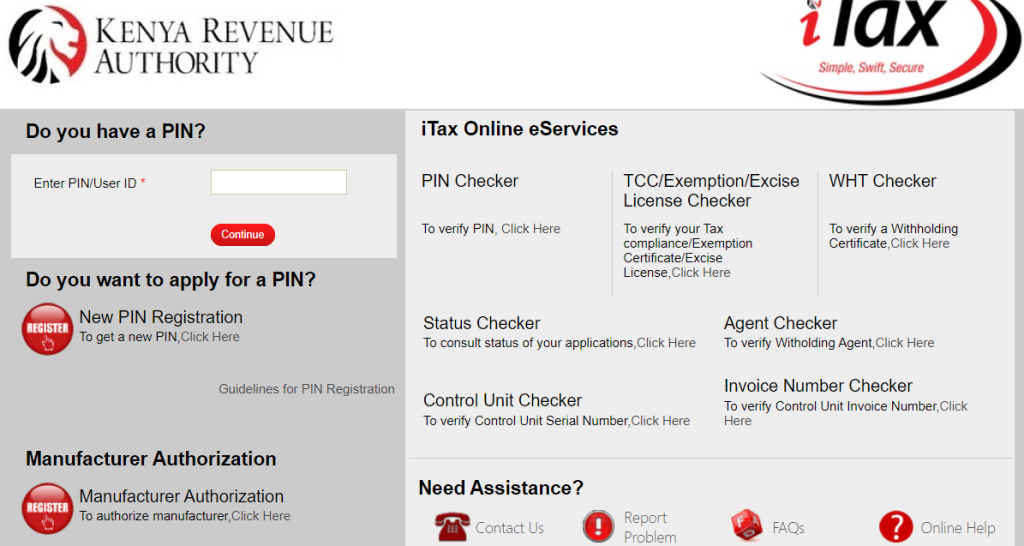

1. Visit the KRA iTax Portal

Start by navigating to the official KRA iTax Portal. This can be done by opening your web browser and typing in iTax Portal. The portal will open in a new browser tab, bringing you to the KRA homepage.

2. Access the PIN Checker Tool

Once on the iTax homepage, look for the “iTax Online eServices” section. In this section, you’ll find an option labeled “PIN Checker.” Click on this option to proceed to the KRA PIN Checker tool.

3. Enter Your KRA PIN Number

In the KRA PIN Checker tool, you’ll need to input your KRA PIN Number. This is a unique identifier assigned to you by the KRA. If you’ve forgotten your KRA PIN Number, you can request a retrieval online, and it will be sent to your email address.

4. Solve the Security Stamp

To confirm your identity, you’ll be prompted to solve a simple arithmetic question known as a “Security Stamp.” This step helps ensure that the request is being made by a human and not an automated system. Enter the correct answer to proceed. # Check Your KRA PIN Using KRA PIN Checker

KRA PIN Checker is a simple and efficient tool designed to help taxpayers verify their KRA PINs. By following the steps outlined above, you can easily confirm the validity and status of your PIN, ensuring that all your tax-related activities are properly aligned.

Whether you’re a business owner, employee, or individual taxpayer, keeping your KRA PIN details accurate is crucial for compliance with Kenya’s tax laws.

Can I get my KRA PIN using my ID number?

Yes, you can retrieve your KRA PIN using your ID number! Here are a few ways to do it:

- KRA iTax Portal: Visit the KRA iTax Portal and use the PIN Checker tool. You can enter your ID number and follow the prompts to retrieve your KRA PIN.

- KRA M-Service App: Download the KRA M-Service app from the Google Play Store. Open the app, sign up using your ID number, and you’ll receive your KRA PIN via email.

- KRA Customer Support: Contact KRA customer support via their official social media pages, email, or WhatsApp. Provide your ID number and request assistance in retrieving your KRA PIN.

- Visit a KRA Office or Huduma Centre: Go to a nearby KRA office or Huduma Centre with your original ID card. The staff will help you retrieve your KRA PIN.

These methods should help you get your KRA PIN quickly and easily.

Can I get my KRA PIN on ecitizen?

Yes, you can retrieve your KRA PIN using the eCitizen platform.

Here’s how:

- Log In to eCitizen: Visit the eCitizen portal and log in using your credentials.

- Navigate to the Business Registration System (BRS): Once logged in, go to the Business Registration System (BRS) section.

- Add a Proprietor: Fill in the required details, including your ID number and first name.

- Search for Your Details: Click on the search button to retrieve your information.

- Retrieve Your KRA PIN: You can find your KRA PIN details in the search results.

If you encounter any issues or need further assistance, KRA’s customer support is available to help you.

Can one deactivate KRA PIN?

Yes, it is possible to deactivate KRA PIN, but it involves a formal process through the Kenya Revenue Authority (KRA). To begin, you must log in to the KRA iTax Portal using your KRA PIN and password.

Once logged in, navigate to the “Registration” tab and select the “E-cancellation” option. Here, you will be prompted to choose the PIN or tax obligation you wish to cancel.

You must provide a valid reason for deactivating your KRA PIN, such as closing your business or no longer needing the PIN for tax purposes. After filling in all necessary details, submit your application for review.

It is important to continue filing returns and fulfilling your tax obligations until you receive official communication from the KRA confirming that your PIN has been successfully deactivated. This process ensures that all legal and financial responsibilities are properly managed, preventing any future complications related to tax compliance.

How much does it cost to retrieve KRA PIN?

Retrieving your KRA PIN is a straightforward process, and it comes at a minimal cost. To retrieve your KRA PIN, you will need to pay a service fee of Ksh 200.

This fee can be paid at a cyber cafe or through other designated payment methods when submitting your request online. Once the fee is paid, you can proceed with the retrieval process by providing your ID number and other necessary details.

The KRA PIN Certificate, which includes your KRA PIN, will then be sent to your email address. This process ensures that you can quickly and easily access your KRA PIN, helping you stay compliant with tax regulations in Kenya. Read how To Download KRA Return Receipt Online?

Conclusion

Using the KRA PIN Checker is a convenient and straightforward way to confirm your KRA PIN details online. By following the outlined steps, you can easily verify your PIN, ensuring you’re always prepared for any personal or business transaction that requires it.

With the KRA PIN Checker, accessing and managing your tax information has never been easier, helping you stay compliant and avoid unnecessary delays in fulfilling your tax obligations.