Read about how to Integrate Paystack to Accept M-Pesa Payments with Stripe? As the digital economy grows, businesses in Kenya are constantly seeking reliable payment solutions to cater to their customers both locally and globally.

Stripe is a well-known option for international payments, while M-Pesa remains the most popular mobile payment platform in Kenya. By integrating Paystack with Stripe, you can seamlessly accept M-Pesa payments alongside other international payment methods.

This guide will walk you through the process of integrating Paystack to accept M-Pesa payments with Stripe, enabling your business to tap into both local and global markets effortlessly. # Integrate Paystack to Accept M-Pesa Payments with Stripe

Does Stripe support Mpesa?

Stripe does not currently support M-pesa directly. However, businesses in Kenya can still use Stripe by incorporating a company in a supported country, such as the United States, and then using Stripe to accept payments. This workaround involves setting up a legal entity and meeting specific requirements to open an account in the selected country.

Once the company is registered and a bank account is opened, businesses can then open a Stripe account and start accepting payments through Stripe in Kenya. This method allows businesses to access Stripe’s services and expand their global reach. # Does Stripe support Mpesa

While it may seem daunting, with the right tools and guidance, it is a straightforward process. Additionally, there are local alternatives to Stripe that support M-Pesa, which businesses can consider if they prefer a more direct solution.

Stripe itself does not directly support M-Pesa. However, you can use Paystack, a Stripe subsidiary, to access M-Pesa and other regional payment methods.

By integrating Paystack into your platform, you can accept payments via M-Pesa, allowing you to cater to customers in Kenya and other parts of Africa.

Would you like more information on how to set up Paystack for M-Pesa payments?

How to Integrate Paystack to Accept M-Pesa Payments with Stripe?

Integrating Paystack to accept M-Pesa payments on your platform can significantly expand your reach in Kenya and other parts of Africa.

Here’s a comprehensive guide on setting it up:

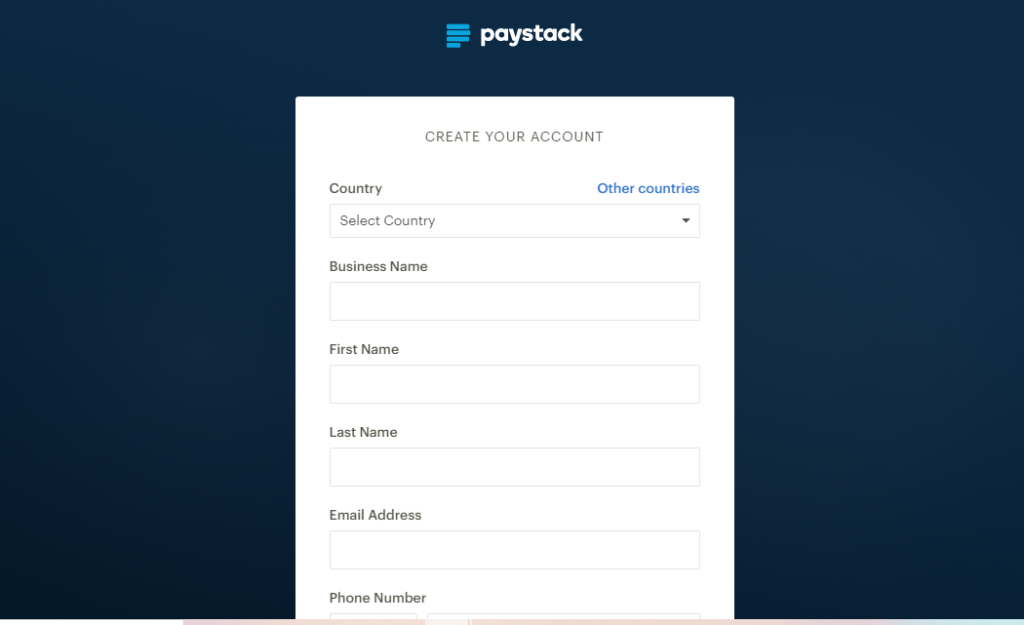

1. Sign Up for Paystack:

Visit the Paystack Website: Go to the Paystack website and create an account by providing your business details. Ensure all information is accurate to avoid any verification issues.

2. Complete Verification:

Submit Documents: After registering, complete the verification process by submitting required documents such as your business registration, ID, and bank account details. Paystack may also request additional information to verify your business. # Integrate Paystack to Accept M-Pesa Payments with Stripe

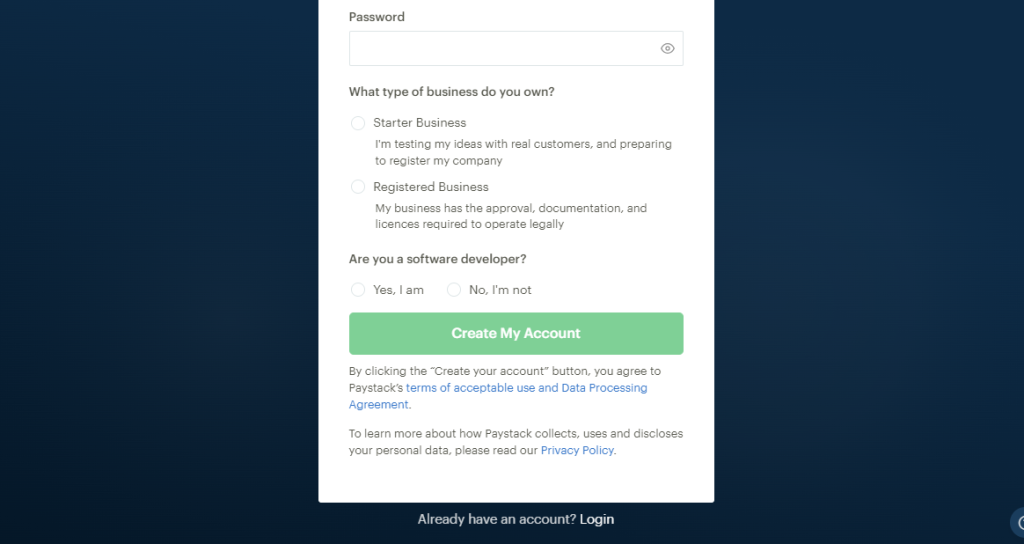

3. Access the Developer Dashboard:

Login and Navigate: Once verified, log into your Paystack account and navigate to the developer dashboard. Here, you will find the API keys needed to integrate Paystack with your website or application.

4. Integrate Paystack API:

Use API Keys: Use the provided API keys to integrate Paystack with your platform. Paystack provides detailed documentation and developer guides to assist you through the integration process. This integration allows you to accept M-Pesa payments, along with other payment methods supported by Paystack.

5. Test the Integration:

Conduct Tests: Before going live, it’s crucial to test the integration to ensure that payments are processed correctly. Paystack offers a test mode that mimics live transactions, allowing you to identify and fix any issues that may arise. # Integrate Paystack to Accept M-Pesa Payments with Stripe

6. Go Live:

Activate Live Mode: Once satisfied with the testing results, switch to live mode. Your platform will now be able to accept payments via M-Pesa and other methods supported by Paystack.

By integrating Paystack with Stripe, you can offer a seamless payment experience for your customers, leveraging both local and international payment methods. This setup not only enhances customer satisfaction but also helps you tap into broader markets, driving growth and expanding your business’s reach.

Is Stripe payment available in Kenya?

Currently, Stripe is not officially available in Kenya, meaning that you cannot directly open a Stripe account in the country to accept payments. However, many Kenyan businesses and freelancers have found creative ways to access Stripe’s services.

One common method is to register a business in a Stripe-supported country, such as the United States or the United Kingdom. This allows them to open a Stripe account using that business entity. # Is Stripe payment available in Kenya

Another alternative is to use virtual banking solutions like Payoneer or Wise (formerly TransferWise) to link their Stripe accounts. These platforms provide virtual bank accounts in supported countries, enabling Kenyan users to receive payments through Stripe.

Although Stripe does not offer full integration with Kenyan payment systems like M-Pesa, there are workarounds. Read about How to open stripe account in Kenya?

Using third-party platforms such as Paystack or Flutterwave, Kenyan businesses can accept local payments in addition to international ones. Paystack and Flutterwave facilitate the integration of various payment methods, including M-Pesa, allowing seamless transactions for both local and global customers.

Conclusion

Integrating Paystack to accept M-Pesa payments with Stripe unlocks significant opportunities for Kenyan businesses. By offering both local and international payment options, you create a smooth and convenient experience for your customers while broadening your market reach.

The combination of Paystack and Stripe provides flexibility, security, and convenience for businesses aiming to serve a diverse clientele. Follow the steps in this guide and leverage both platforms to enhance your payment capabilities and drive business growth.