This post covers how to withdraw money from Payoneer in Kenya? Navigating the world of online payments can be both exciting and challenging, especially for freelancers and businesses in Kenya. Payoneer has emerged as a vital tool, allowing users to receive payments from international clients seamlessly.

However, understanding how to withdraw your hard-earned money from Payoneer can be a bit perplexing. # withdraw money from Payoneer in Kenya

This guide will walk you through the step-by-step process of withdrawing funds from your Payoneer account in Kenya, ensuring you can access your money swiftly and efficiently.

What is Payoneer?

Payoneer is a global financial services company that provides online money transfer and digital payment services. It allows businesses and professionals to receive payments from international clients and marketplaces, manage funds in multiple currencies, and make payments globally.

Here are some key features:

Multi-Currency Account:

Users can hold and manage funds in various currencies, making it easier to handle international transactions.

Global Reach:

Payoneer supports transactions in over 190 countries and territories, making it a versatile tool for global commerce.

Payment Solutions:

It offers services like receiving payments from marketplaces (e.g., Amazon, Upwork), sending payments to suppliers, and withdrawing funds to local bank accounts.

Prepaid Debit Card:

Users can get a Payoneer Prepaid Debit MasterCard, which can be used for online purchases or ATM withdrawals.

Payoneer simplifies cross-border payments, making it a valuable tool for freelancers, small and medium-sized businesses, and large enterprises looking to expand their global reach.

Is Payoneer Available in Kenya?

Yes, Payoneer is available in Kenya. It is a popular online payment solution that allows users to receive payments from international companies directly to their Payoneer account.

This service is especially beneficial for freelancers, bloggers, and businesses in Kenya who work with international clients.

How to Open a Payoneer Account in Kenya?

Setting up a Payoneer account is a breeze! Just follow these steps:

- Visit the Payoneer Website

- Head over to the Payoneer website and hit the “Sign Up” button.

- Complete the Registration Form

- Enter your personal details, including your name, email address, and phone number. Use your primary email as it will be your identifier for payments.

- Create a strong password and agree to the terms and conditions. Click “Continue.”

- Verify Your Email Address

- Check your email for a verification link from Payoneer. Click the link to verify your email.

- Verify Your Identity

- Upload a government-issued ID (passport or national ID card) to verify your identity. Ensure the ID is valid and displays your name, photo, and address.

- Provide Business Details

- Once your documents are approved, fill out a brief questionnaire about your business. This helps Payoneer understand your usage and ensures regulatory compliance.

After submitting the questionnaire, Payoneer will review your account. This process usually takes a few days but can extend up to a week. Once approved, you’ll have full access to your account dashboard and can start using Payoneer’s services!

Does Payoneer Work with M-Pesa?

Currently, Payoneer does not have an official integration with M-Pesa. However, there are alternative methods to transfer money from Payoneer to M-Pesa:

Using Money Transfer Services:

You can use services like Wise or WorldRemit to transfer money from your Payoneer account to your M-Pesa account. This involves transferring funds from Payoneer to a local bank account and then using the money transfer service to send the money to M-Pesa.

Local Dealers:

Some local dealers offer Payoneer to M-Pesa transfer services, but these come with risks and may not be officially endorsed.

While these methods are not as seamless as direct integration, they provide viable options for accessing your Payoneer funds through M-Pesa.

Can You Withdraw Funds from Payoneer to M-Pesa?

If you’re in Kenya and looking to withdraw your funds from Payoneer to M-Pesa, you’ll be glad to know it’s possible. However, it’s not as straightforward as a simple click due to the lack of direct integration between the two platforms.

But don’t worry; I’ll break it down for you in easy steps!

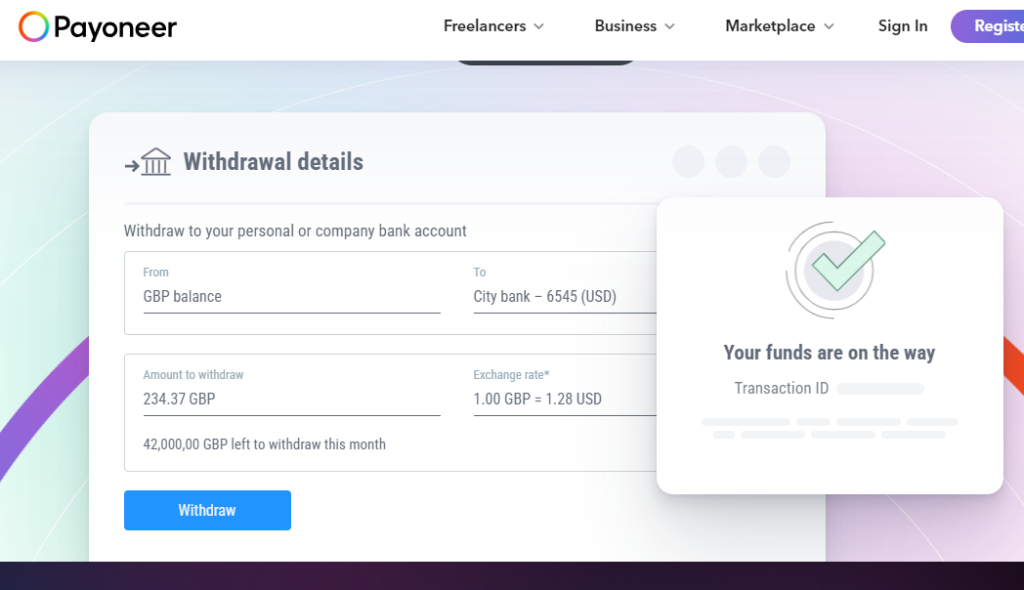

Step 1: Withdraw to Your Local Bank Account

First things first, you need to transfer your Payoneer funds to a local bank account. Start by linking your bank account to your Payoneer account. Once that’s set up, you can initiate the withdrawal. It’s a simple process, but it may take a couple of days for the funds to reflect in your bank account.

Step 2: Move Funds to M-Pesa

With your money now in your bank account, the next step is to get it into your M-Pesa. You can easily do this through your bank’s mobile banking app or by visiting an M-Pesa agent to deposit the cash directly. It’s quick and efficient, allowing you to access your funds whenever you need them.

Step 3: Explore Third-Party Services

If you’re looking for a more direct approach, some third-party services can facilitate a transfer from Payoneer to M-Pesa. However, be mindful of any fees they may charge.

It’s wise to shop around and compare options to find the best deal. # Payoneer to M-Pesa

As you navigate this process, always keep an eye on the associated fees and exchange rates, especially if you’re dealing with multiple currencies. With these steps in hand, withdrawing your Payoneer funds to M-Pesa should be a breeze!

How to Fund Your Payoneer Account in Kenya?

Adding money to your Payoneer account in Kenya can be done through various methods. # Fund Your Payoneer Account

Here’s a step-by-step guide:

- Receive Payments from Clients

- Freelance Platforms: If you’re a freelancer, platforms like Upwork, Fiverr, and others allow you to transfer your earnings directly to Payoneer.

- Direct Payments: You can receive funds from clients who use Payoneer or through bank transfers if they use Payoneer to send money.

- Bank Transfer

- Local Bank Transfer: If you have a local bank account linked to your Payoneer account, you can move funds from your bank to Payoneer. Ensure your bank supports such transactions.

- Payoneer Global Payment Service

- This service enables you to receive payments from companies globally as if you had a local bank account in various countries. Provide your Payoneer bank account details to your client, and they can deposit funds directly into your Payoneer account.

- Using a Credit or Debit Card

- In some instances, you can add funds to your Payoneer account using a credit or debit card. Check the available options in your Payoneer account settings under “Add Funds” or “Funding Sources.”

- Third-Party Payment Processors

- Some online payment processors may allow you to transfer funds to your Payoneer account. Ensure the service is legitimate and understand any fees involved.

Always be aware of the fees associated with each method of adding money to your Payoneer account. Pay attention to the currency of the funds you are depositing and any potential exchange rates that may apply.

With these methods, funding your Payoneer account in Kenya should be simple and convenient! # Fund Your Payoneer Account

Read About ghris payslip

How Secure is the Payoneer Digital Wallet?

Payoneer incorporates a range of robust security measures to safeguard your account. A key feature is two-factor authentication (2FA), which sends a unique code to your registered mobile number. To log in, you must enter this code alongside your email and password.

Additionally, Payoneer uses SSL encryption to protect your personal and financial information from unauthorized access as it moves across the internet. This encryption shields your data from potential interception by bots and malware.

The platform also employs advanced fraud detection systems to monitor any suspicious activity on your account. Notifications via email or text are sent when certain account activities occur, keeping you informed in real-time.

During the registration process, Payoneer allows you to set up security questions, adding an extra layer of protection against unauthorized access. The platform can further limit login attempts to specific IP addresses, enhancing security.

A limit on the number of login attempts adds another safeguard, helping to prevent brute force attacks on your account.

Despite these comprehensive security features, staying vigilant is essential. Always safeguard your password and personal information, avoid phishing scams, and be cautious of unsolicited messages claiming to be from Payoneer. Ensure you log in by typing the Payoneer URL directly into your browser, and never share sensitive information like your card PIN.

Conclusion

Withdrawing money from Payoneer in Kenya doesn’t have to be a daunting task. By following the outlined steps, you can easily access your funds and enjoy the flexibility that comes with international payments.

Whether you’re a freelancer, a small business owner, or someone who receives payments from overseas, understanding this process will empower you to manage your finances more effectively. Start leveraging Payoneer today and unlock new possibilities for your financial transactions!